Today’s typical healthcare billing experience is confusing and frustrating. For many, challenges with healthcare billing are so common that these issues begin to feel like just another part of going to the doctor’s office. Here is an issue I recently faced - one that highlights why healthcare payment experience is a particularly complex issue.

I was experiencing pain in my shoulder last year, and I went to see a doctor. During the visit, I had to sign a pre-authorized amount towards the service. Everything went smoothly, but confusion started two weeks after the visit when I received an Explanation of Benefit (EOB) from my insurance plan that looked like a bill for an amount I might owe, yet there was a bold disclaimer: “This is not a bill.” The frustration continued when I received a bill from my doctor’s office for my payment responsibility, which was printed and mailed months after my visit and failed to clearly indicate what was due or how to pay. Sure enough, after making the payment, I received a credit from the doctor's office for the payment I made.

My challenges are a microcosm of a larger dilemma: The U.S. healthcare system often fails to meet the needs of patients during billing and payment collection time which, ultimately, undermines the performance of payors and providers alike.

So, what’s going wrong? The current claims and reimbursement process for healthcare is slow and inefficient, the patient’s payment responsibility is often unclear, and there is often little communication between the payors and the multiple providers. The ensuing confusion regarding payment can cause patients to default on their payments, not follow-through on referrals, cause bad publicity, or even worse, switch providers/payors. Non-reimbursed costs of care alone lead to significant financial burdens for the healthcare system as a whole. For example, in 2016, U.S. hospitals and health systems provided more than $38.3 billion in uncompensated care1 to their patients.

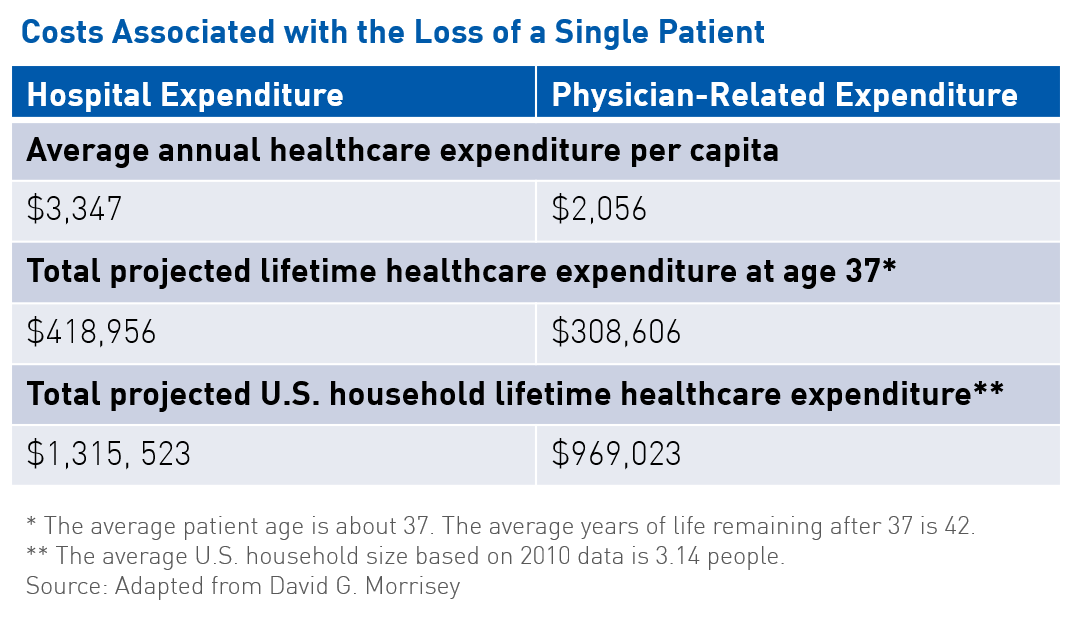

Poor financial experience can also lead to reduced loyalty and lower assessments of quality of care received. Attrition at even single-digit levels adds up, with as little as seven percent representing more than $100 million in lost annual revenue per hospital. The loss of a single patient contributes to the loss of their associated household healthcare expenditure, which, according to statistics from the U.S. Census Bureau, is estimated at $1.3 million for hospitals and approximately $1.0 million for physician-related expenses (see table). Moreover, reputation based on a patient’s experience impacts whether or not the patient returns to an organization or recommends it to those in his/her social network, affecting both payors’ and providers’ bottom lines.

Additional systemic costs occur in the form of clinical non-adherence. In some cases, the poor financial experience can lead to patients not following through on the doctor’s referrals. This can result in prolonged absences from the workplace, putting a further financial strain on patients and family caregivers and draining business productivity. Paid sick leaves cost the national economy $160 billion annually in lost productivity.2

None of these outcomes are desirable, and as the healthcare system transitions from volume to value, these are costs that the system can no longer afford.

The Economic Value of Improved Payment Experience

Improving payment experience not only reduces the cost of healthcare for patients, providers, and the healthcare ecosystem, but also helps retain consumers and drive loyalty. The Advisory Board Company reported that a 10 percent increase in customer loyalty could generate more than $22 million in revenue for an average hospital.

A number of approaches can be taken to improve payment experience, including people, process, and technology enhancements. In addition to these organizational improvements, providers and payors alike should consider analyzing and identifying improvement opportunities along the payment journey through the core Customer Experience dimensions of empathy, ease, relevance, and orchestration. The touchpoints that have the highest combined impact on the patient and the business are critical to creating and delivering the optimal payment experience.

Once you have analyzed and prioritized key touchpoints to deliver along these dimensions, you are now in a position to improve patient payment experience, which can then lead to improvements in overall healthcare quality and result in savings for patients and the U.S. healthcare system.

Notes:

- Uncompensated care is the total amount of healthcare services, based on full established charges, provided to patients who are either unable or unwilling to pay. Uncompensated care includes both charity care and bad debt.

- (Unpublished calculation based on $225.8 billion annually in lost productivity, 71 percent due to presenteeism). Inflation calculation for 2017 dollars based on the calculation of $160.32 billion in 2002 dollars using U.S. Inflation Calculator available at http://www.usinflationcalculator.com